“How to Avoid Common Investment Scams”

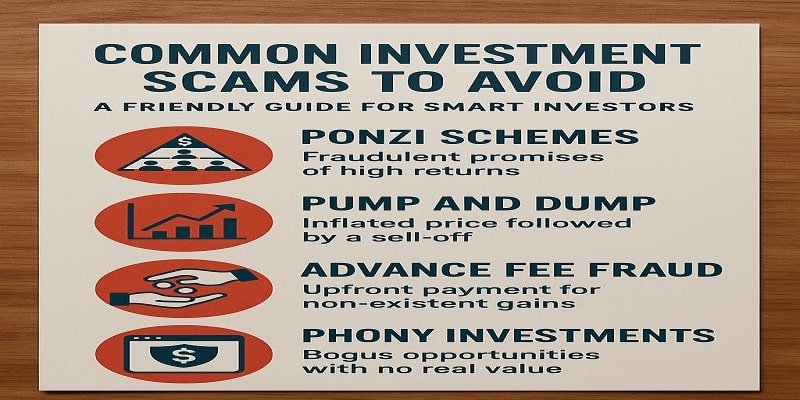

How to Avoid Common Investment Scams: Investing your hard-earned money is a great way to make money, but not all opportunities are legitimate. Scammers are always looking for new ways to steal your money, and even experienced investors can fall prey to them if they’re not careful.

In this guide, we’ll explain the most common investment scams in the U.S., how to recognize them, and what you can do to protect yourself. By staying informed, you can avoid losing money to fraud and make better financial decisions.

1. Ponzi Scheme: False Profits Trap

One of the most notorious common investment scams is the Ponzi scheme. Named after Charles Ponzi, who popularized the scam in the 1920s, these scams promise high returns with little or no risk.

How it works:

- Scammers lure investors in and promise them great profits.

- Instead of actually investing the money, they use the money from new investors to pay “returns” to old investors.

- When there aren’t enough new investors to continue the payments, the scheme fails.

Red flags:

- “Guaranteed” high returns – No legitimate investment is risk-free.

- Secretive or complicated strategies – Be skeptical if you don’t understand how the money is made.

- Pressure to recruit others – Many Ponzi schemes rely on creating new victims.

How to avoid it:

- Research the company through the SEC’s EDGAR database.

- Be skeptical of anything that sounds too good to be true.

2. Pump-and-dump schemes: Fake hype, real losses

Another common investment scam is the pump-and-dump scheme, often seen with penny stocks or cryptocurrencies.

How it works:

- Fraudsters buy cheap stocks (or crypto) and create false hype to drive the price up.

- When the price rises, they sell (dump) their shares, leaving other investors with worthless assets.

Warnings:

- Unsolicited investment suggestions (especially via social media or email).

- Claims of a “once in a lifetime” opportunity.

- Sudden, unexplained price spikes in undervalued stocks.

How to avoid it:

- Ignore “hot tips” from strangers.

- Check stock history at FINRA’s Market Data Center.

3. Fake investment advisors: Fake experts

Scammers often dupe people by posing as financial advisors, brokers, or even “wealth managers” to get them to hand over their money.

How it works:

- They offer you “special” investment opportunities via phone, email, or social media.

- Once you invest, they disappear with your money.

Warning signs:

- Lack of proper licensing (always verify via [FINRA’s BrokerCheck](https://brokercheck.finra.org/)).

- High-pressure sales strategies (push you into taking action immediately).

- Unregistered investments (check with the SEC or state regulators).

How to avoid it:

- Never trust an advisor who isn’t verified.

- Ask for documentation and do your own research.

4. Cryptocurrency Scams: The Digital Wild West

With the rise of Bitcoin and other cryptocurrencies, scams have grown exponentially. Some of the most common investment scams in crypto include:

- Fake exchanges – fraudulent platforms that steal deposits.

- Rug pulls – developers abandon a project after taking investors’ money.

- Phishing scams – fake emails or websites tricking you into giving away your wallet keys.

Warning bells:

- Promises of huge and fast returns.

- Anonymous developers (no real team behind the project).

- Unrealistic claims (“Earn 1000% in a week!”).

How to avoid it:

- Stick to well-known exchanges like Coinbase or Kraken.

- Never share private keys or passwords.

5. Real estate investment fraud: too easy to be true

Real estate can be a great investment, but scammers take advantage of people looking for passive income.

Common scams:

- Fake rental properties – scammers list homes they don’t own.

- Land flipping schemes – selling expensive, worthless land.

- REIT (real estate investment trust) fraud – fake funds that don’t actually invest in real estate.

Warning signs:

- Pressure to invest right away.

- Physical property tours are not allowed.

- Unregistered sellers (always check licenses).

How to avoid it:

- Verify property listings through county records.

- Work with licensed real estate agents.

How to Protect Yourself from Investment Scams

Although scammers are clever, you can outsmart them by:

✅ Do your research before you invest – check the SEC, FINRA, and BBB.

✅ Avoid “guaranteed” returns – all investments carry risk.

✅ Ignore unsolicited offers – if you haven’t looked for it, be careful.

✅ Consult a trusted financial advisor – get a second opinion.

Final Thoughts: How to Avoid Common Investment Scams

Investment scams come in many forms, but all of them prey on greed, fear, or lack of information. By recognizing common investment scams and staying vigilant, you can protect your money and invest wisely.

For more tips on avoiding fraud, see:

Stay smart, stay safe, and happy investing!

FAQs on How to Avoid Common Investment Scams

1. How to identify a scam?

- Guaranteed high returns

- Pressure to invest quickly

- Unverified sellers

2. What if I get scammed?

- Freeze accounts and warn banks

3. Are crypto investments safe?

- High risk, many scams

- Only use trusted exchanges (Coinbase, Kraken)

4. Can I get back lost money?

- Rare, but report immediately

- Legal action possible

5. Best protection?

- Do research before investing

- Verify advisors through FINRA