“How to Teach Kids About Money”

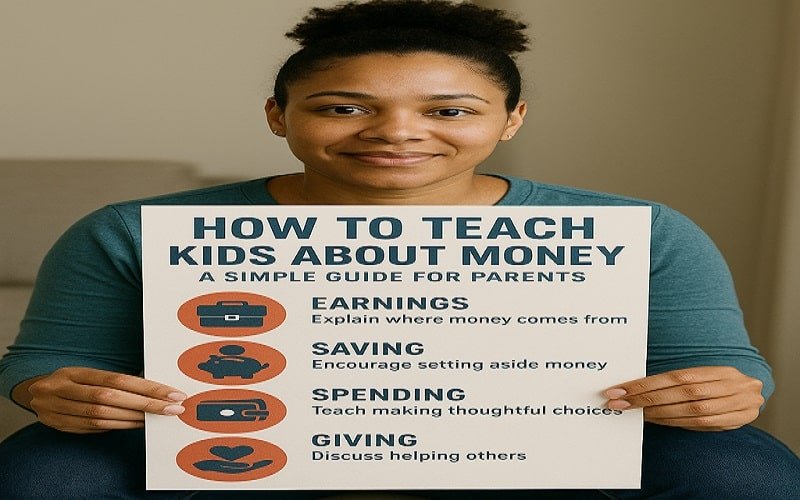

How to Teach Kids About Money: Teaching kids about money is one of the most important life skills you can give them. When kids understand the value of money early on, they grow up to be financially responsible adults. But where to start? How do you teach a 5-year-old or teen about budgeting, saving, and spending wisely?

This guide teaches kids about money in simple and practical ways—no finance degree required! We’ll share age-appropriate lessons, fun activities, and real-world tips to help your child build good money habits.

Why Teaching Kids About Money Is Important

Many adults have money problems because they were never taught the basics as children. By introducing financial concepts at an early age, you set your child up for success. Here’s why it’s so important:

- Builds good habits – Kids who learn to save and spend wisely are less likely to face debt problems later on.

- Promotes responsibility – Managing even small amounts of money teaches accountability.

- Prepares them for the real world – From college expenses to car installments, money skills are essential.

Now, let’s learn how to teach kids about money at every age.

Money lessons by age group

3-5 years: Money basics

Young kids won’t understand complex ideas, but they can learn that money is used to buy things.

- Use a transparent jar for savings – Piggy banks are fun, but a transparent jar gives them a chance to watch their money grow.

- Play “shop” at home – use fake money to “buy” toys or snacks, which helps them learn about exchange and value.

- Keep lessons simple – explain that money is earned by working (for example, doing odd jobs for a dollar).

6-10 years: saving and spending wisely

At this stage, children can understand more detailed concepts.

- Give an allowance (purposeful) – instead of giving free money, tie it to chores so you can learn to work hard.

- Teach the “three jars” method – label jars for spending, saving, and sharing (donating).

- Let them make small purchases – if they want a toy, help them compare prices and wait before buying.

🔗 Recommended: Money as You Grow – CFPB (great for age-based activities!)

Ages 11-13: Budgeting and Earnings

Pre-teens can handle more responsibility.

- Open a kids’ bank account – many banks open accounts for teens with parental supervision.

- Help them set savings goals – want a bicycle? Explain how much they need to save each week.

- Teach basic budgeting – show them how to track income (allowance, gifts) vs. spending.

Ages 14-18: Real-world money skills

Teens should learn skills they’ll use as adults.

- Teach them about credit – explain how credit cards work (and what the dangers of debt are).

- Encourage a part-time job – babysitting or mowing the lawn develops work ethic and income management.

- Discuss the cost of college – if they plan to go, talk about student loans vs. scholarships.

🔗 Recommended: MyMoney.gov – Youth Resources (US government-backed financial tips)

Fun ways to teach kids about money

Learning doesn’t have to be boring! Try these interesting methods:

✔ Board games – Monopoly or The Game of Life teach earning, spending, and investing.

✔ Grocery store challenges – Give them $10 to buy snacks while staying on a budget.

✔ Family money talks – Discuss bills (in simple terms) so they understand managing money in real life.

Common mistakes to avoid

Even well-meaning parents can make mistakes when teaching kids about money. Keep these things in mind:

- Giving too much too soon – If kids always get what they want, they won’t learn delayed gratification.

- Not leading by example – If you overspend, they’ll adopt the same habits.

- Avoid money talk – Kids understand financial stress; explain the basics without fear.

Final Tips for Success

1. Start early – even young children can learn simple money concepts.

2. Practice consistently – repeat the lesson over time.

3. Make it relevant – use examples they care about (toys, games, outings).

Teaching kids about money doesn’t have to be a chore. With patience and practice, you’ll raise a child who is confident and smart about his finances.

💡 Want more tips? Check out JumpStart’s Financial Education Resources (a nonprofit focused on youth financial literacy).

Your Turn!

What money lessons have worked for your kids? Share your tips in the comments!

By following this guide, you’re not just teaching kids about money—you’re setting them up for a lifetime of financial security. Get started today and watch them become money-conscious adults!

FAQs on How to Teach Kids About Money

1. At what age should I start teaching my child about money?

Start with simple things like coins and saving around the age of 3-5. Slowly introduce more complex topics as they get older.

2. Should I give my child an allowance?

Yes, but tie it to household chores or responsibilities to teach them that money is earned, not just given.

3. How do I teach my child the difference between needs and wants?

Use real-life examples (e.g., “We need groceries, but we want candy”) and let them make small spending choices.

4. Is it okay to talk about family finances with kids?

Yes, in an age-appropriate way. Simple discussions about budgeting and saving help them understand real-world money management.

5. What’s the best way to teach kids about saving?

Use a clear savings jar, set small goals (like a toy), and celebrate when they reach their goals to encourage good habits.