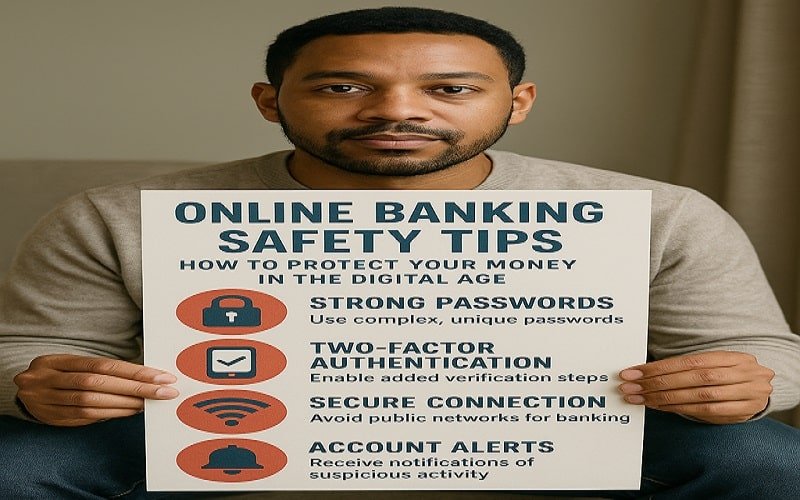

“Online Banking Safety Tips”

Online Banking Safety Tips: Online banking has made managing money easier than ever—no more waiting in line at the bank or keeping track of a paper checkbook. But with this convenience comes the risk of fraud, scams, and identity theft. The good news? A few smart habits can keep your accounts safe.

Whether you’re checking your balance, paying bills, or transferring money, following these online banking security tips will help you bank with confidence.

1. Use a strong and unique password

Your password is the first line of defense against hackers. Avoid easy-to-guess passwords like “123456” or “password.” Instead:

- Use a mix of capital letters, numbers, and symbols.

- Keep it to a minimum of 12 characters.

- Don’t reuse passwords across multiple accounts.

Consider using a password manager (such as Bitwarden or LastPass) to store and generate secure passwords.

2. Enable two-factor authentication (2FA)

Two-factor authentication adds an extra layer of security. Even if someone steals your password, they won’t be able to access your account without a second verification step, such as:

- A text message code

- An authentication app (Google Authenticator, Authy)

- A fingerprint or face scan

Most banks offer 2FA—turn it on in your account settings.

3. Beware of phishing scams

Scammers often pretend to be your bank via email, text, or fake websites (called “phishing”). Red flags include:

- Instant messages like “Your account is locked!”

- Links to unfamiliar websites

- Requests for personal information (like your SSN or password)

Always log in directly from your bank’s official app or website—never click on a link in an email.

4. Use secure Wi-Fi networks

Public Wi-Fi (coffee shops, airports) is risky because hackers can monitor your activities. For secure online banking:

- Use your mobile data or a VPN (like NordVPN)

- Avoid accessing bank accounts on public computers.

5. Keep your devices updated

Outdated software has security flaws that hackers exploit. Protect yourself in these ways:

- Turn on automatic updates for your phone, computer, and apps.

- Install antivirus software (like Malwarebytes).

6. Monitor your accounts regularly

Detecting fraud early reduces losses. Adopt these habits:

- Check transactions every week.

- Set up bank alerts for large withdrawals or logins.

- Review your annual credit report (free at AnnualCreditReport.com).

7. Use only official banking apps

Fake banking apps can steal your information. Always:

- Download apps only from the official app store or Google Play.

- Check reviews and developer details before installing.

8. Be smart about sharing information

Never give out banking details unless you have been contacted. Fraudsters may call using your bank’s name—hang up and call the official number on your card.

Final Thoughts: Online Banking Safety Tips

Following these online banking security tips reduces the risk of fraud. Be vigilant, use strong security measures, and trust your instincts—if something looks fishy, double-check with your bank.

For more security advice, see:

- Federal Trade Commission (FTC) – Identity Theft Protection

- Consumer Financial Protection Bureau (CFPB) – Banking Safely Online

FAQs on Online Banking Safety Tips

1. How do I create a strong password for online banking?

Use a mix of capital letters, numbers, and symbols (e.g., `B@nk1ng$ecure!`). Avoid easy-to-guess names like birthdays or “password123.” A password manager can help create and store secure passwords.

2. What should I do if I get a suspicious email from my “bank”?

Don’t click or respond to the link. Log in directly from your bank’s official website or app to see the alert. Forward phishing emails to your bank’s fraud department.

3. Is it safe to use online banking on public Wi-Fi?

No public Wi-Fi is risky. Use mobile data or a VPN for encryption. Never check bank accounts on a shared or unsecured network.

4. What is two-factor authentication (2FA), and why is it important?

2FA adds an extra security step (such as a text code or fingerprint) to logging in. Even if someone steals your password, they can’t access your account without another verification.

5. How often should I check my bank account for fraud?

At least once a week. Set up transaction alerts to quickly spot unauthorized activity. Report any suspicious charges to your bank immediately.

Stay safe and bank smart!